mobile county al sales tax form

Motor FuelGasolineOther Fuel Tax Form. Direct Petition for Refund.

Sales Tax Alabama Department Of Revenue

The current Mobile County Resolution levying the County Sales Use Lease and Lodging taxes may be found here.

. Business Personal Property andor Personal Aircraft Return. Refund worksheet for destroyed stamps. Monthly Report County and OTP.

Consumer Use Tax. Sales Tax Form 12. Sales and Use Tax.

Petition for Release of Penalty. SalesSellers UseConsumers Use Tax Form. Declaration of US Citizenship Letter - Form A.

If you need information for tax rates or returns prior to 712003 please contact our office. 1-855-638-7092For tax information and assistance contact the Department of Revenue. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal Staff may visit your property to review or update property information.

Tobacco Tax 1150 Government Street Room 112 Mobile AL 36604 251-574-8580 251-574-8599 FAX TobaccoTaxmobilecountyalgov Hours. Sales and Use Tax. Joint Petition for Refund.

Access forms specific to Sales Use Tax. Monthly report for city cigarette stamps. Food Beverage Tax Form 7.

Please print out the forms complete and mail them to. The December 2020 total local sales tax rate was also 5500. Direct Petition for Refund.

Per 40-2A-15h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may call ALTIST Certified Auditors Complaint Hotline. Returns can be filed by using one of the following options. Motor FuelGasolineOther Fuel Tax Form.

SALES USE TAX MONTHLYTAX RETURN. Revenue Forms and Applications. NOTICE TO PROPERTY OWNERS and OCCUPANTS.

To report a criminal tax violation please call 251 344-4737. Mobile AL 36652-3065 Office. Upon the proper completion of a Motor Fuels Gas Excise Tax Application pre-printed forms will be mailed out.

Leasing Tax Form 3. Mobile AL 36652-3065 Office. The current total local sales tax rate in Mobile County AL is 5500.

Leasing Tax Form 3. Customer Satisfaction Survey. For a copy of our Lodging Tax report form click here.

1-334-844-4706 Toll Free. Section 34-22 Provisions of state sales tax statutes applicable to article states The taxes levied by this article shall be subject to all definitions. MONTH COVERED BYTHIS REPORT PERIOD COVERED BYTHIS REPORT From.

Taxpayer Bill of Rights. Heres how Mobile Countys maximum sales tax rate of 10 compares to other counties. SalesSellers UseConsumers Use Tax Form.

The county sales use and lease tax levies parallel the State of Alabama Sales Use and Lease. FIGURES MAY BE ROUNDED TO NEAREST DOLLAR. Sales Tax General Gross.

SALES USE TAX MONTHLYTAX RETURN 12. A county-wide sales tax rate of 15 is applicable to localities in Mobile County in addition to the 4 Alabama sales tax. The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales tax.

County City Combo stamp order form. Tax rates for Mobile County. Prepare and file your sales tax with ease with a solution built just for you.

Avalara can help your business. Declaration of US Citizenship Letter. The current total local sales tax rate in Mobile County AL is 5500.

Business License Renewals. Ad Have you expanded beyond marketplace selling. Declaration of US Citizenship Letter - Form B.

Board of Equalization-Appeals Form. You are most likely already paying your State salesuse taxes through ONE SPOT-MAT so you only need to add. Food Beverage Tax Form 7.

The Mobile County Sales Tax is collected by the merchant on all qualifying sales made within Mobile County. Some cities and local governments in Mobile County collect additional local sales taxes which can be as high as 45. Joint Petition for Refund.

Is this a final return Yes No. The Mobile County Sales Tax is 15. 8 AM - 4 PM Kay A Hart-Tobacco Tax Collector.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as 100 mail fee for decalsA mail fee of 250 will apply for customers receiving new metal plates. Business entities that file and pay Mobile County Sales Use Lease Automotive Lodging and Mobile County School Sales and Use Taxes should file and pay using the ONE SPOT system accessible through the State of Alabama My Alabama Taxes MAT website. Sales Tax Form 12.

CITYOF MOBILE POBOX 2745 MOBILEAL36652-2745 PHONE 251 208-7461. To report non-filers please email. Petition for Release of Penalty.

Application for Developers Values. Drawer 161009 Mobile AL 36616 251. For tax rate information please contact the Department at 256-532-3498 or at salestaxmadisoncountyalgov.

Developers Price Value List. Petition for Release of Penalty. Mobile county al sales tax form Monday May 30 2022 Edit.

Mobile County collects a 15 local sales tax less than the 3 max local sales. However However pursuant to Section 40-23-7 Code of Alabama 1975 you may request quarterly filing status if you have a tax liability of less than 240000 for the preceding calendar year. 2 Forms Alabama Department Of Revenue Alabama Resale Certificate Pdf Fill Online Printable Fillable Blank Pdffiller Alabama Tax Forms H R Block Coffee County Alabama Utility Trailer Bill Of Sale Form Download Printable Pdf Templateroller.

Application for Current Use Valuation for Class 3 Property Return. Mobile County property owners are required to pay property taxes annually to. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales.

PLEASE NOTE your assigned account number is to be used for all taxes reported such as sales use lease and lodging. 10 Auto 05 Consumers Use Tax General Gross. Free viewers are required for some of the attached documents.

County stamp order form.

Fake Reviews Are A Growing Problem For Consumers And The Local And Product Search Sites They Rely On To Mak Learning Techniques Online Reviews Search Marketing

Alabama Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsoft Word To Be Used As A Sal Bills Things To Sell Alabama

Michigan Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsoft Word Bill Of Sale Template Templates Bills

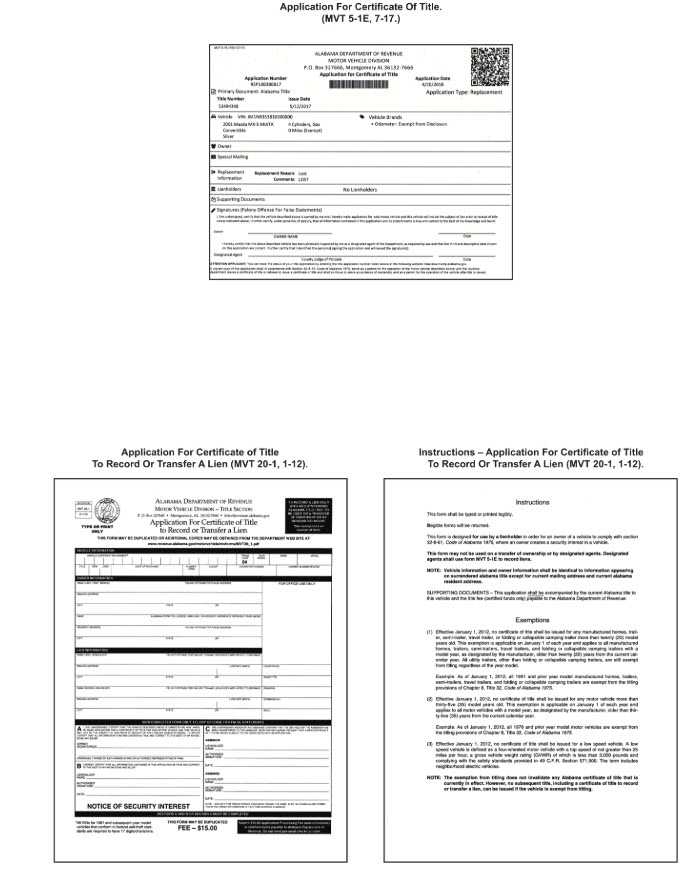

Alabama Tax Title Registration Requirements Process Street

California Tax Forms H R Block

Sales And Use Alabama Department Of Revenue

Myusacorporation Europe Services And Pricing S Corporation Country Flags Interactive

Alabama Tax Title Registration Requirements Process Street

Free Alabama Mobile Home Bill Of Sale Template And Printable Form Usa Estimation Qs

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

New York State Sales Tax Login Tax Ny Gov File Online New York State Tax State Tax

Alabama Tax Title Registration Requirements Process Street

Free Alabama Bill Of Sale Template Word Pdf Legaltemplates

Printable Sample Bill Of Sale Alabama Form Real Estate Forms Room Rental Agreement Bill Of Sale Template

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com